Working with affiliates is a powerful marketing tool that has proven its efficiency over and over again.

While you can invest in paid advertising platforms such as Google Ads, potential customers are more likely to buy your product if recommendations come from a person they trust. In this case, that is an affiliate.

Just look at it this way: would you rather buy something advertised on TV or recommended by your loved one? With affiliate marketing strategies you can still market your products to a wide audience. Even better, you can reach those people who are most likely to buy them.

Unfortunately, unlike with paid marketing ads, two issues come with affiliate programs. First, you will need to pay the affiliates on time for the best results. Second, you will need to follow IRS guidelines for tax compliance.

The Pain Called Taxes

It is safe to say that no one enjoys doing taxes. As a business owner, you know what pain it is to stay on top of tax regulations that are constantly changing. Studying these regulations that vary from state to state is time-consuming. Even worse, it can keep you away from more important tasks that make money.

There are two issues with taxes:

- Tax forms need to be filled out accurately and on time

- You need to know all kinds of federal, state, and local tax regulations

If you do not do your taxes on time or you do not understand tax regulations completely, you can end up with a hefty fine or even business closure.

When it comes to affiliates, many businesses wait until the last minute (which is often the very end of the year) to collect tax IDS and prepare 1099. If you worked with an affiliate until let’s say March, you have probably lost touch with them by the end of the year.

To do the taxes, a staff member will need to track down that affiliate and ask them for proper tax documentation. This process can be confusing and time-consuming. Eventually, you may not be able to complete the end-of-year reporting in time, resulting in fines.

Issues with Late Payments

To do their taxes, brands will need to fill out a Form 1099-NEC for each affiliate that earned more than $600 in the tax year. However, if you are late with payments, you may not be able to calculate how much money you have spent on each affiliate on time. Of course, that is not the only issue with late payments.

Lack of Reliable Reporting

Affiliates create content and promote certain products in exchange for money. Problems can come up if they are not sure when they will be paid next.

First, they can stop promoting your products and give up on you. This is bad news for you because training and educating new affiliates is, at the end of the day, far more expensive than maintaining fruitful relationships with old ones.

Second, without regular payments, your brand’s performance marketers won’t be able to make decisions regarding promotions. With Google Ads and Facebook Ads, performance marketers receive detailed analytics and can come up with clever strategies. The same needs to happen with affiliate program reporting.

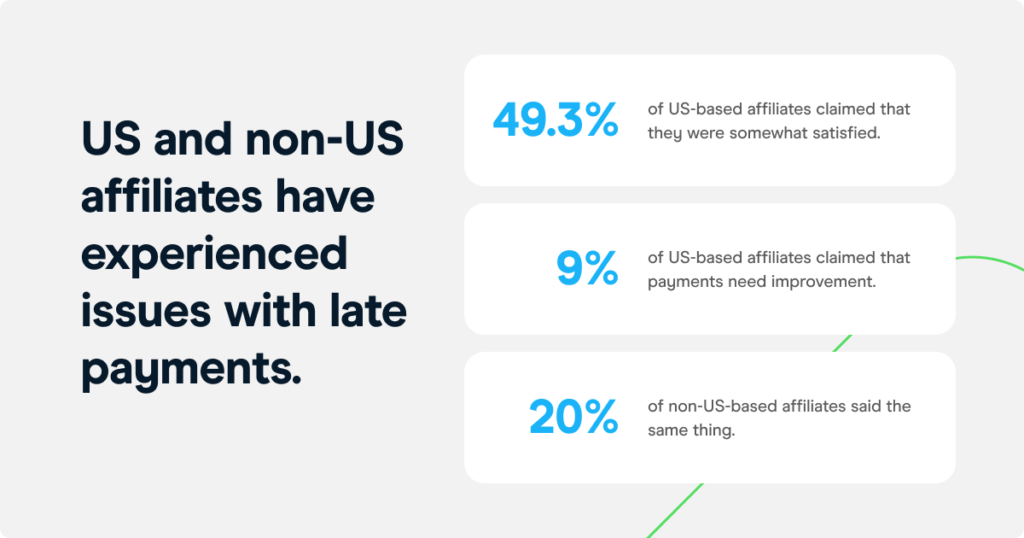

Even though the issues attached to irregular payments are very clear, most affiliates receive untimely payments.

A study has shown that both US and non-US affiliates have experienced issues with late payments. However, in many cases, global affiliates found themselves in a situation where they did not receive a payment at all. When it comes to payment satisfaction, 49.3 % of US-based affiliates claimed that they were somewhat satisfied. While 9% of US-based affiliates claim that payments need improvement, almost 20% of non-US-based affiliates say the same thing.

The Bottom Line

Collecting tax documents at the last minute can lead to many problems, especially if you have to contact affiliates you have lost touch with in the meantime.

The very beginning of the year is the ideal time to start collecting your tax documentation for the following year. Although this seems like an exhausting task, you do not have to do this manually. Refersion Pay can guarantee regular, on-time commission payments and save you time on tax management.

With this platform, you can automate order conversion approvals and schedule payments, as well as provide valuable tax information to your affiliates. It allows you to quickly and effortlessly collect all of your affiliate W-9’s to submit and distribute 1099’s.

Thanks to this solution, your brand can stand out of the crowd, strengthen relationships with affiliates and keep them motivated to boost your sales.